When thinking about buying a home, there’s one thing many shoppers zero in on: the purchase price. And well, that makes a lot of sense. Price is important, but it’s not the only factor that determines whether a home is truly affordable for you. In this blog, we’ll explore how smart financing can make a bigger difference than a price reduction ever could.

Here at Taylor Morrison, we offer finance incentives that can help you save more over time, often lowering your monthly payments and easing upfront costs at closing. Let’s take a look at common homebuying myths and what really matters when it comes to affordability.

Myth: Lower Price = Lower Payment

Colonnade Cornerstone in McCordsville, IN

While it’s easy to assume that if you pay less for a home, you’ll automatically pay less each month, it’s not always the full story.

Many buyers are hyper-focused on the total home price, rather than the long-term cost of homeownership. In reality, your monthly mortgage is shaped by more than just the price tag—and with the right financing plan, you may be able to afford more home while paying less per month.

Taylor Morrison offers finance incentives that can reduce your interest rate, lower your monthly payment, and even help with upfront costs at closing. This could save you thousands over time!

Understanding What Really Impacts Your Monthly Payment

Auburn Glen Towns in Dacula, GA

Your monthly mortgage payment is made up of several key components.

Loan Amount

The principal you borrow from your lender.

Interest Rate

A lower rate reduces your monthly costs.

Loan Term

A 30-year mortgage will generally have a lower monthly payment than a 15-year loan.

For more on loan programs, click here.

Taxes and Insurance

Property taxes and homeowners’ insurance add to your monthly expenses.

HOA Dues

Some communities include homeowners’ association fees, but here’s the good news: Taylor Morrison offers incentives that can help cover up to the first year of HOA dues at closing.

Why Interest Rates Matter More Than You Might Think

Even a small change in your mortgage interest rate can make a difference in your monthly payment and long-term savings.

Example 1

Let’s say you’re buying a $400,000 home with 5% down.

- At a 7.25% interest rate, your estimated principal and interest payment would be around $2,592/month.

- Drop the rate to 5.75%, and that payment could fall to about $2,218/month.

That’s a savings of nearly $375 every month, over $135,000 across a 30-year loan.

Example 2

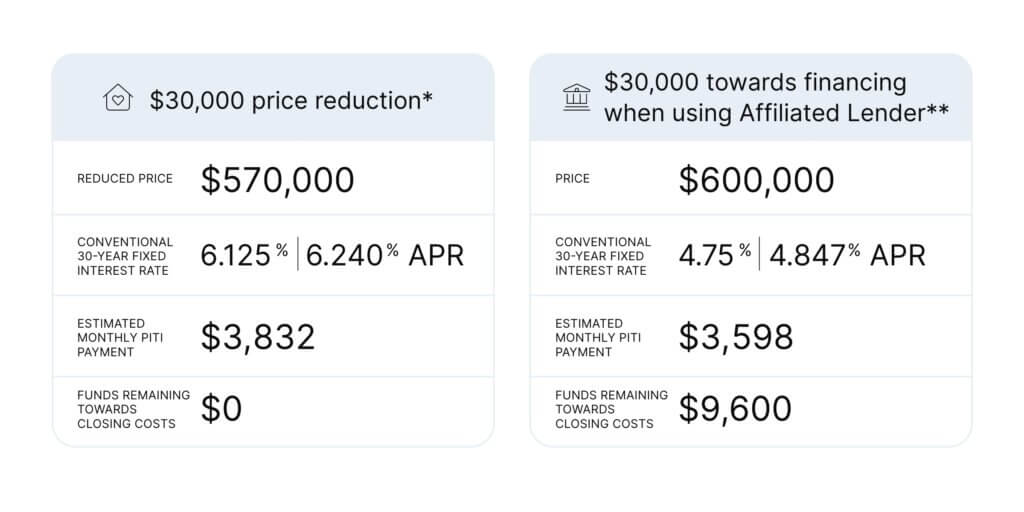

This chart shows us that although the left purchase price is lower, your monthly payment would be $234 more, with $0 remaining to help with closing costs.

Although the purchase price on the right is higher, the interest rate is lower, saving you money per month and leaving you with $9,600 to help with closing costs!

Looking for more information on closing costs? Find definitions, types, and ways to save here.

How Taylor Morrison’s Finance Incentives Help You Win

River Landing in Wesley Chapel, FL

We offer exclusive programs through Taylor Morrison Home Funding* that help you buy with confidence:

Buy, Build, Flex™ Program

Save and enjoy flexibility when you lock your rate

Have you been waiting for lower rates to afford a new home? With Buy Build Flex™, you can secure a rate 1% lower than the current market through our Affiliated Lender, Taylor Morrison Home Funding.

ARO® Program

Plus, Taylor Morrison Home Funding can help you improve your credit score, free of charge, through our Able. Ready. Own. ® Program.

Why this matters: a better credit score could mean a lower interest rate.

Able

Our professional ARO® Coordinators are here to help you strengthen your credit profile, offer practical tips to improve your credit score, and guide you in documenting your situation so you’re well-prepared to purchase your new home.

Ready

They’ll be with with you every step of the way. Once you’re enrolled, your personalized credit improvement plan will be put into action, using proven strategies to strengthen your score and qualification profile. A stronger credit foundation brings you closer to the mortgage program that’s right for you.

Own

Successfully completing the ARO® program makes you a stronger, more qualified home loan candidate. With ARO®’s stamp of approval, you’ll gain the buying power you need to move forward with confidence.

Long-Term Financial Health

Carmello at Roberts Ranch in Vacaville, CA

Choosing a home with better financing can set you up for success far beyond move-in day. Lower monthly payments can improve your cash flow, giving you more room to save. Over the course of your loan, a reduced interest rate can save you tens of thousands of dollars, more than a typical price reduction ever could.

It’s not just about affording a home today—it’s about building financial wellness for the future.

Thanks for Reading

If you stayed with us, thanks for reading! Ready to start on the path to homeownership? The experts at Taylor Morrison Home Funding are here to help you make confident, informed decisions—with personalized financing that’s tailored to you.

Make smart moves! Visit our Make Moves page to see exclusive savings in your area.

Blog is intended for general informational purposes only and not as an exhaustive comparison of all factors applicable to your personal financial situation. Data used was derived from third-party sources and deemed reliable as of the date obtained, but not guaranteed, offered as investment or tax advice, or independently verified by Taylor Morrison; all information remains subject to change outside of Taylor Morrison’s control. *Buyer is not required to finance through Affiliated Lender and/or to use such Closing Agent selected by Seller to purchase a home; however, Buyer must use both the Closing Agent selected by Seller and finance through Affiliated Lender to receive certain finance promotions. Taylor Morrison Home Funding, Inc., NMLS #8588, 495 North Keller Road, Suite 550, Maitland, FL 32751; Licensed Locations: AZ: #0917436 | CA: DFPI #4130023 | CO Registration #8588, ph. #866-379-5390 | FL: MLD1920 | GA: #52654| IN: #DFI-66890 | NV: #3938 (branch located at 1820 Festival Plaza Dr., Ste. 220A, Las Vegas, NV 89135 PH# 702-680-1085) | NC: #L-191654 | OR: #ML-4272 | SC: #MLS-8588 | TX: #8588 | WA: #CL-8588: www.nmlsconsumeraccess.org. Able.Ready.Own® and ARO® are federally registered Marks of Taylor Morrison, Inc. and used by its affiliates with its permission. See https://www.taylormorrisonhf.com/ for complete details and licensing information. All rights reserved.