This just in: more than 400 attendees joined our recent homebuying webinar to explore tools, financing options, and expert tips designed to simplify the path to homeownership. Whether you’re just starting your search or ready to move into a new home, this recap covers the highlights and answers common questions from buyers across the country.

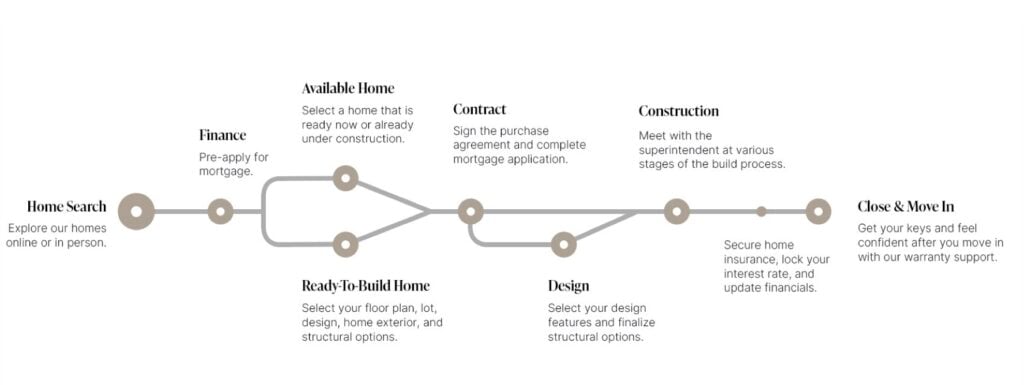

A Step-by-Step Look at the Homebuying Journey

We’re determined to be as flexible and collaborative as possible. You can start online, schedule an in-person visit, or connect virtually with a team member. Once you’re ready to get started, the journey includes:

- Pre-applying with our affiliated lender, Taylor Morrison Home Funding for your financing needs*

- Choosing your home—whether it’s move-in ready or still under construction

- Personalizing your exterior and interior finishes if you’re building from the ground up

- Closing and moving in, with support from Taylor Morrison’s affiliated lender, title company, and insurer

- Post move-in support from the warranty team

From selecting your floor plan to picking out finishes, every step is supported by experts who care.

Financing Made Simple

Mortgage financing can feel overwhelming, but it doesn’t have to be. Here are a few myths, busted.

Perfection, Not Needed

You don’t need perfect credit—some loan programs start at 600 credit scores.

Down Payments Don’t Have to Be Daunting

Down payments can be as low as 0% for VA and USDA loans.

Lower Price Isn’t Always Best

A lower home price doesn’t always mean a lower monthly payment—interest rates matter.

ARM’s Aren’t Scary

Adjustable-rate mortgages may be a better fit for short-term goals.

Ditch The Rent

Owning can be more affordable than renting, especially with stable monthly payments and warranties

Loan Types for You

Taylor Morrison Home Funding, Inc. offers a variety of loan types, including conventional, FHA, VA, and USDA, each tailored to different financial situations.

Understanding Mortgage Qualification

Lenders look at four key areas—often called the “Four C’s”:

- Collateral: The value of the home

- Cash: Your down payment and closing costs

- Capacity: Your ability to repay the loan based on income and debt

- Credit: Your history of managing debt

Helpful tip: Keep credit card balances below 30% of your limit and avoid late payments to maintain a strong score.

Credit Support That’s Free and Personalized

Ready to take control of your credit score? Taylor Morrison Home Funding, Inc. offers a complimentary service called ARO (Able Ready Own) to help improve your credit profile. Whether you’re working to qualify or just want to boost your score for better rates, ARO consultants provide personalized guidance with no obligation to buy or finance through Taylor Morrison Home Funding, Inc.

Incentives That Work for You

Taylor Morrison offers closing credits that can be used in several ways when using our affiliated lender, Taylor Morrison Home Funding, Inc.

- Cover upfront costs like lender fees, title insurance, and appraisal fees

- Buy down your interest rate for long-term savings

- Lower your monthly payment with a temporary rate buydown

- Offset mortgage insurance costs

- Lock in your rate for homes still under construction, with a free float-down option if rates drop before closing

These tailored incentives are designed to meet your unique needs and make homeownership more accessible.

Spotlight: Semi-Annual Sale & Limited-Time Rates

Our Semi-Annual Sale is happening now, offering exclusive savings and reduced interest rates for a limited time with our affiliated lender.

Whether you’re looking to move quickly or build from the ground up, this is a great opportunity to take advantage of tailored financial incentives.

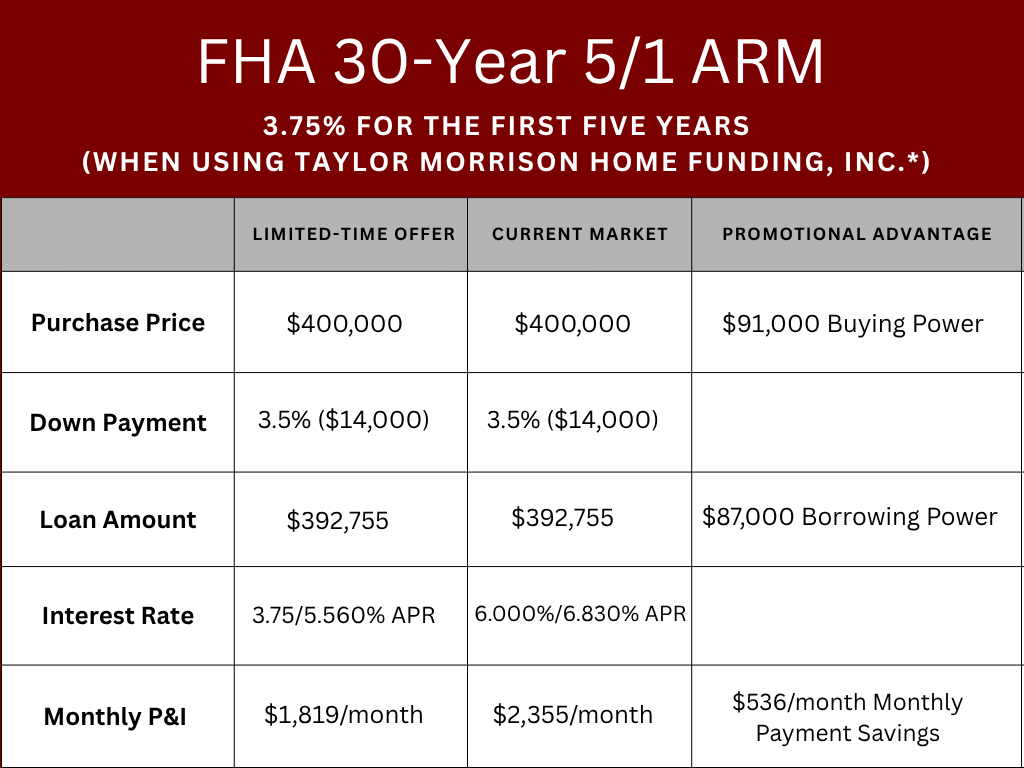

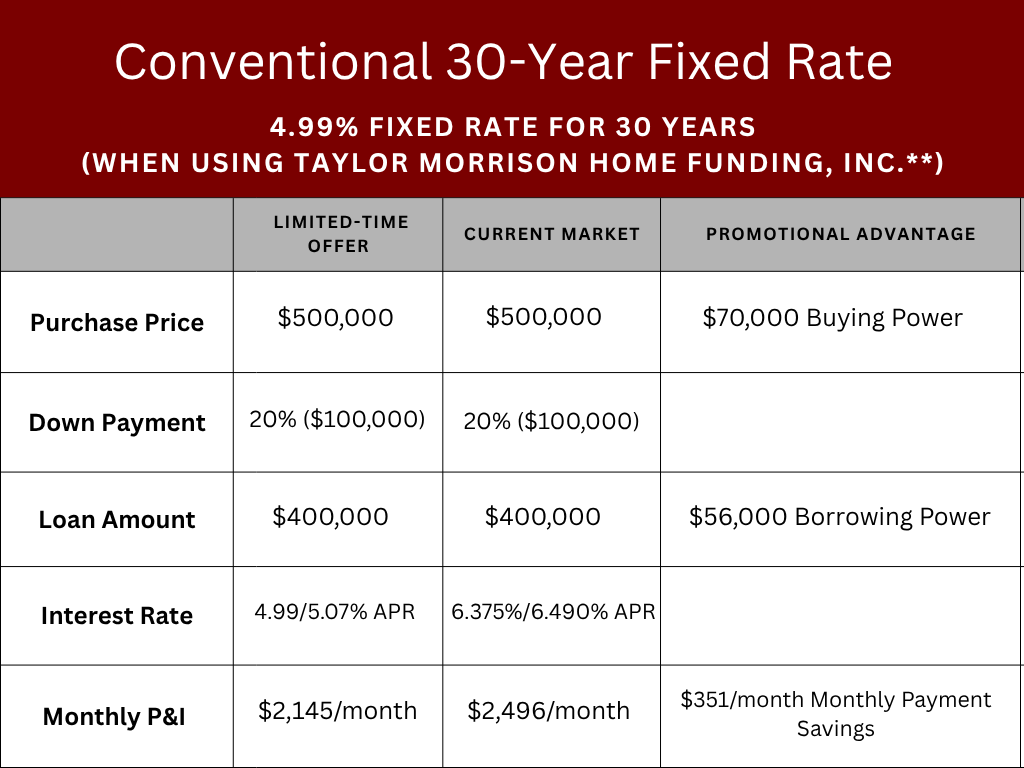

Limited-Time Offer Examples for Quick Move-In Homes

These programs are especially helpful for move-up buyers or those transitioning from renting.

Adjustable-Rate Mortgages vs. Conventional 30-Year Fixed Rate Mortgages

To achieve the same payment as the limited-time reduced rate promotion, you would need to purchase a home for $308,975 and borrow $303,379.

Disclaimer 1

To achieve the same payment as our limited-time reduced rate promotion, you would need to purchase a home for $371,164 and borrow $296,931.

Disclaimer 2

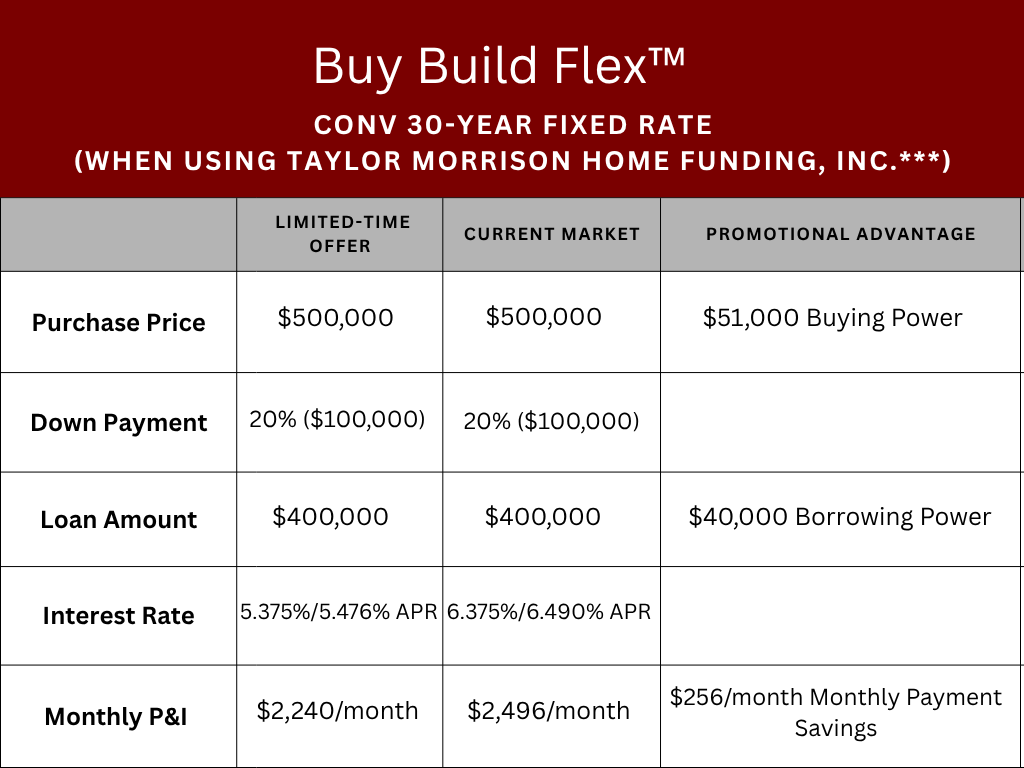

Buy Build Flex™

Secure a rate 1% lower than the current market through Taylor Morrison Home Funding, Inc.

Disclaimer 3

Rate Locks and Buydowns

Securing favorable mortgage terms is crucial, and two tools that can help you achieve this are rate locks and buydowns. For a full breakdown on both, click here.

No-Interest FHA options

Taylor Morrison will pay for your interest for the first seven months when obtaining an FHA 30-Year Fixed Rate mortgage when utilizing Taylor Morrison Home Funding, Inc. Our limited-time Seller Paid Interest Subsidy (“Promotion”) can help you replenish your down payment or rebuild savings. Watch your savings grow, refill your pockets, and watch your future take shape.

Online Tools That Put You in Control

Taylor Morrison’s website makes it easy to:

Browse

Explore available lots and personalize floor plans.

Buy Online

Reserve a home online—just like shopping on Amazon.

Design

Browse curated design collections or shop model home furniture.

Get Questions Answered

Access FAQs, expert tips, and a downloadable homebuying guide

Whether you’re browsing late at night or ready to take the next step, everything is designed to be simple and stress-free.

More Than a House | You’re Finding Home

We’re here to help you navigate every step, from financing to design all the way to move-in day. Whether it’s your first new construction purchase or your third Taylor Morrison home, you’ll find a team that puts your needs first.

- *FHA 30 Year 5/1 ARM Disclaimer:

*FHA 30 Year 5/1 ARM infographic is intended for general informational purposes only and not as an exhaustive comparison of all factors applicable to your personal financial situation. Infographic based upon Limited Time Adjustable Rate Mortgage (“ARM”) Interest Rate starting at 3.75% / 5.56% APR (“Promotion”). Advertised Annual Percentage Rate (“APR”) of 5.56% APR is based on an FHA 5/1 ARM, 30-year fully amortizing term, with a Total Purchase Price of $400,000 and a loan amount of $392,755, 3.5% down payment and 640 median credit score. Available for FHA loan limits, owner-occupied only. The initial starting interest rate is 3.75% for 60 months. After the initial period, the variable interest rate and payment may adjust every twelve months and equal the total of the 30-Day Average Treasury Rate index (3.610% as of 9/23/25) plus a margin of 2.00%. The maximum change in the interest rate is up to 1% at the first adjustment, up to 1% every twelve months thereafter with a maximum lifetime adjustment of 5% (max life interest rate of 8.75%) and your payment will increase. Advertised estimated monthly payment is based on FHA 30 Year Fixed Rate Mortgage with a Total Purchase Price of $400,000 and loan amount of $392,755 and includes principal and interest only. Estimated monthly tax and insurance premiums are not included in the above calculation. Monthly HOA dues paid separately based on the HOA’s then current assessments and are not included in the advertised payment. Taylor Morrison has locked in, through Taylor Morrison Home Funding, Inc. (“Affiliated Lender”), an adjustable interest rate for a pool of funds. Rate is only available for a limited time until pool of funds is either depleted or rate expires. Advertised estimated monthly payment is based on an interest rate for a 45-day rate lock effective 9/26/25 with a 6.00% / 6.830% Annual Percentage Rate (“APR”). APR of 6.830% is based on an owner-occupied, FHA 30-year fixed mortgage, Total Purchase Price of $400,000 and loan amount of $392,755, 3.5% down payment, 640 median credit score. Payment includes Principal and Interest only. Estimated monthly tax and insurance premiums are not included in the above calculation. Monthly HOA dues paid separately based on the HOA’s then current assessments and are not included in the above calculation. Rates may vary depending on program, down payment and loan amount, market fluctuations, as well as other factors outside of the Seller or Approved Lender’s control. $128,000 is calculated using the principal and interest payment difference of $643 per month with a 6.00% interest rate with a 30-year term.

↩︎ - Conventional 30-Year Fixed rate disclaimer:

**Conventional 30-Year Fixed rate infographic is intended for general informational purposes only and not as an exhaustive comparison of all factors applicable to your personal financial situation. Infographic based upon Limited Time Fixed Interest Rate 4.99% / 5.07% APR (“Promotion). The advertised annual percentage rate (“APR”) of 5.07% is calculated on a Conventional 30-Year fixed rate mortgage with a Total Sales Price of $500,000 and a loan amount of $400,000, 20% down payment and 780 median credit score. Available for conventional conforming loan limits, owner-occupied only. Taylor Morrison has locked in, through Taylor Morrison Home Funding, Inc. (“Affiliated Lender”), a fixed interest rate for a pool of funds (minimum loan amount $225,000). Rate is only available for a limited time until pool of funds is either depleted or rate expires. Advertised estimated monthly payment is based on Conventional 30 Year Fixed Rate Mortgage with a Total Purchase Price of $500,000 and loan amount of $400,000 and includes principal and interest only. Monthly HOA dues paid separately based on the HOA’s then current assessments and are not included in the advertised payment. Taylor Morrison has locked in, through Taylor Morrison Home Funding, Inc. (“Affiliated Lender”), an adjustable interest rate for a pool of funds. Rate is only available for a limited time until pool of funds is either depleted or rate expires. Advertised estimated monthly payment is based on an interest rate for a 45-day rate lock effective 9/19/25 with a 6.375% / 6.490% Annual Percentage Rate (“APR”). APR of 6.490% is based on an owner-occupied, FHA 30-year fixed mortgage, Total Purchase Price of $500,000 and loan amount of $400,000, 20% down payment, 780 median credit score. Payment includes Principal and Interest only. Estimated monthly tax and insurance premiums are not included in the above calculation. Monthly HOA dues paid separately based on the HOA’s then current assessments and are not included in the above calculation. Rates may vary depending on program, down payment and loan amount, market fluctuations, as well as other factors outside of the Seller or Approved Lender’s control. $70,000 is calculated using the principal and interest payment difference of $351 per month with a 6.375% interest rate with a 30-year term. ↩︎ - Buy Build Flex Conventional 30-Year Fixed disclaimer:

***Buy Build Flex Conventional 30-Year Fixed infographic is intended for general informational purposes only and not as an exhaustive comparison of all factors applicable to your personal financial situation. Infographic based upon Limited Time Buy Build Flex (“Promotion”).Taylor Morrison has secured, through Taylor Morrison Home Funding, Inc. (“Affiliated Lender”), a pool of funds that may be utilized to reduce interest rate by 1% based upon current market rates posted daily on www.mortgagenewsdaily.com and is available for a limited time or until pool of funds is depleted. Buyer must reserve funds as of the Purchase Agreement Date and may elect to secure rate at any time during construction. Promotion may be offered in addition to, and not in lieu of, any additional Seller closing cost incentives, if applicable, as outlined in the Incentive Addendum to the Purchase Agreement. Available loan products are Conventional, FHA and VA. Interest rates and available loan products are subject to underwriting, loan qualification, and program guidelines. Actual savings will vary by the community, floor plan, lot premium, options of home and availability. Other restrictions may apply. Advertised estimated monthly payment is based on an interest rate for a 45-day rate lock effective 9/19/25 with a 6.375% / 6.490% Annual Percentage Rate (“APR”). APR of 6.490% is based on an owner-occupied, Conventional 30-year fixed mortgage, Total Purchase Price of $500,000 and loan amount of $400,000, 20% down payment, 780 median credit score. Payment includes Principal and Interest only. Estimated monthly tax and insurance premiums are not included in the above calculation. Monthly HOA dues paid separately based on the HOA’s then current assessments and are not included in the above calculation. Rates may vary depending on program, down payment and loan amount, market fluctuations, as well as other factors outside of the Seller or Approved Lender’s control. Rates may vary depending on program, down payment and loan amount, market fluctuations, as well as other factors outside of the Seller or Approved Lender’s control. $51,000 is calculated using the principal and interest payment difference of $256 per month with a 5.375% interest rate with a 30-year term. ↩︎

Webinar disclaimer:

Nothing related to this complimentary Informational Webinar should be construed as legal, accounting or tax advice and it is offered for general informational purposes only. Certain incentives and seller contributions may require the use of certain lenders and/or title companies for eligibility, some of which may be affiliates of your Eligible Home’s Taylor Morrison selling entity, and could affect your loan amount. Not all buyers will qualify for all offers. Please consult a Taylor Morrison Community Sales Manager, visit www.taylormorrison.com for our Legal Terms, Privacy Policy, Licensing and additional disclaimers and review a Purchase Agreement for additional information, disclosures and disclaimers. All information (including, but not limited to prices, views, availability, school assignments and ratings, incentives, floor plans, exteriors, site plans, features, standards and options, assessments and fees, planned amenities, programs, conceptual artists’ renderings and community development plans) is not guaranteed and remains subject to change, availability or delay without notice. All Eligible Homes subject to prior sale. This is not an offer in any state where prohibited or otherwise restricted by law. Please see a Taylor Morrison Community Sales Manager or Online Sales Manager for details and visit www.taylormorrison.com for additional state or community specific disclaimers, licensing information or other details (as applicable). © October 2025, Taylor Morrison, Inc. and its respective selling entities (collectively, “Taylor Morrison”). All rights reserved.

Eligibility clause:

For eligibility of the above finance Promotion, Qualified Buyer of an Eligible Home must (1) pre-apply with Affiliated Lender by visiting www.taylormorrison.com/home-financing prior to submitting offer to qualify for the finance Promotion; (2) use the services of Closing Agent selected only by Seller and finance with Affiliated Lender; and (3) satisfy all other closing date and eligibility criteria (each, an “Eligible Home”). Seller reserves the right to modify the above finance Promotion terms and/or Promotion Period at any time prior to contract. Buyer is not required to finance through Affiliated Lender and/or to use such Closing Agent selected by Seller to purchase a home; however, Buyer must use both the Closing Agent selected by Seller and finance through Affiliated Lender to receive the finance Promotion. Interest rates and available loan products are subject to underwriting, loan qualification, and program guidelines. Maximum seller contributions apply. Not to be combined with any other incentive offer, except as otherwise expressly set forth above or in an Incentive Addendum to the Purchase Agreement. Other restrictions may apply. Not all Borrowers will qualify. Services not available in all states. Taylor Morrison Home Funding, Inc. NMLS #8588, 495 N. Keller Rd. Suite 550, Maitland, FL 32751. Licensed locations: AZ: #0917436 | CA: DFPI #4130023 | CO: Registration #8588, PH# (866) 379-5390 | FL: MLD1920 | GA: #52654 | IN: #DFI-66890 | NV: #3938 (branch located at 1820 Festival Plaza Dr., Ste. 220A, Las Vegas, NV 89135 PH# 702-680-1085) | NC: #L-191654 | OR: #ML-4272 | SC: #MLS-8588 | TX: #8588 | WA: #CL-8588 | www.nmlsconsumeraccess.org

AFFILIATED BUSINESS ARRANGEMENT DISCLOSURE STATEMENT

This is to give you notice that the Builder who is making this referral and is more particularly identified in the applicable purchase agreement (“Selling Entity”), has a business relationship with Taylor Morrison Insurance Services. Specifically, the Selling Entity and Taylor Morrison Insurance Services are affiliates with the same parent corporation. Because of this relationship, this referral may provide Selling Entity with a financial or other benefit.