Disclaimer1

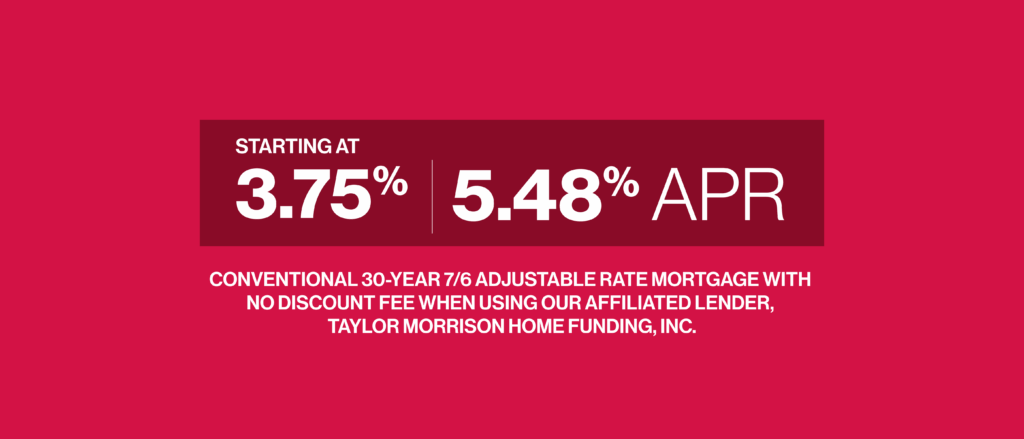

A powerful financing option is helping shoppers like you get into the homes they want most. For a limited time, secure a Conventional 30-Year 7/6 adjustable-rate mortgage with no discount fee and enjoy a starting 3.75% / 5.48% APR* for the first 7 years of your loan.

Wondering what all that means? We’ve got you. Read on for a full breakdown on how ARMs work, and why it might be the right choice for your next move.

What is an Adjustable-Rate Mortgage?

An adjustable-rate mortgage (“ARM”) is a home loan with an introductory interest rate that adjusts at regular intervals over time. In contrast to a fixed-rate mortgage, where your interest rate stays the same for the life of the loan, an ARM gives you a lower initial rate and monthly payment during the early years.

Going Deeper: How ARMS Actually Work

For those who love the details, here’s what’s happening when you choose a 7/6 Conventional ARM.

Initial Fixed Rate Period

For the first 7 years of the loan, the interest rate is fixed, meaning it stays the same, and monthly payments remain consistent.

Adjustment Period

After the initial 7 years, the interest rate can adjust every six months for the remaining loan term (23 years for a 30-year loan).

Principal and Interest Payments

The payment required to repay a home loan in accordance with its terms.

What Rate Adjustments are Based On

Index

A published rate that reflects general market conditions, like the cost of borrowing money in the broader economy. This 7/6 ARM is tied to the Secured Overnight Finance Rate (“SOFR”).

Margin

A fixed percentage, set by your lender, that’s added to your index to determine your new rate.

Protections Built In With Rate Caps

Worried about dramatic rate increases after the initial period? No need to stress, thanks to rate caps:

- Initial cap: This limits how much your interest rate can increase the very first time it adjusts when the initial fixed period ends (5% with a 3.75%/ 5.48% APR)

- Adjustment cap: This limits how much your interest rate can change after the first adjustment (1% with a 3.75%/ 5.48% APR)

- Lifetime cap: This is the maximum amount your interest rate can ever increase over the life of the loan (5% with a 3.75%/ 5.48% APR)

Benefits of an ARM for New Construction Homebuyers

Looking for reasons to buy a new home financed with a 7/6 ARM? Here’s why:

Qualification…

is based on the introductory rate.

Lower initial monthly payments…

can free up cash for upgrades or other personal goals.

Who Should Consider an ARM?

Esplanade at Azario Lakewood Ranch in Lakewood Ranch, FL

- Borrowers who plan to sell or refinance within 7 years may take advantage of the lower initial rate and potentially avoid the adjustment period altogether.

- Borrowers who expect their income to increase may anticipate being able to afford higher payments in the future.

- Borrowers seeking lower initial payments may consider that the initial rate on a 7/6 ARM is typically lower than a fixed rate, resulting in lower monthly payments during the first 7 years.

Trust and Transparency: The Risks of an ARM

No tricks. No surprises. We want you to know all the benefits, and all the risks, so that you can make intelligent, informed decisions.

Payment Changes

Monthly payments can increase if interest rates rise after the fixed-rate period ends.

Complexity

ARMs can be more complex than fixed-rate mortgages, with terms and concepts like index, margin, and caps.

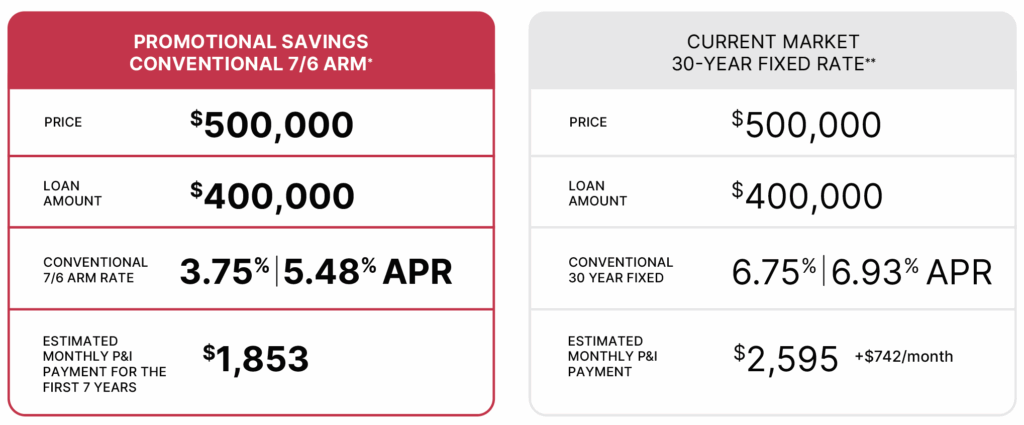

See the Savings: ARM vs. Fixed Rate Mortgage

Enjoy a monthly principal and interest payment up to $742 less than the current market rate. With a reduced rate, you can borrow up to $114,000 more on a home you love. ***

How to Explore ARM Options with Confidence

Choosing a mortgage is a big decision, but you won’t be alone. Our “Affiliated Lender”, Taylor Morrison Home Funding (TMHF), is here to guide you every step of the way. They’ll walk you through:

- Understanding your financial goals, both short-term and long-term

- Comparing loan programs and choosing the best fit

- Navigating an ARM with clarity and confidence

Thanks for Reading!

An ARM can open the door to upfront savings and greater flexibility. Explore whether a 7/6 ARM is right for you by reaching out to Taylor Morrison Home Funding today. Let’s get you one step closer to home, and the rate, you’ve been waiting for!

Disclaimer

*Limited Time Conventional 7/6 Adjustable Rate Mortgage (“ARM”) Interest Rate starting at 3.75% / 5.48% APR (“Promotion”) valid on new home contracts entered as of 8/1/25-8/30/25 (“Promotion Period”) on select eligible Quick Move-in Homes that close on or before 9/26/25 (each, an “Eligible Home”). The advertised annual percentage rate (“APR”) of 5.48% APR is based on a Conventional 7/6 ARM, 30-year fully amortizing term, with a Total Purchase Price of $500,000 and a loan amount of $400,000, 20% down payment and 780 median credit score. The initial starting interest rate is 3.75% for 84 months. After the initial period, the variable interest rate and payment may adjust every six months and equal the total of the 30-Day Average SOFR index (4.341% as of 7/31/25) plus a margin of 2.75%. The maximum change in the interest rate is up to 5% at the first adjustment, up to 1% every six months thereafter with a maximum lifetime adjustment of 5% (max life interest rate of 8.75%) and your payment will increase. Available for conventional conforming loan limits, owner-occupied only. Taylor Morrison has locked in, through Taylor Morrison Home Funding, Inc. (“Affiliated Lender”), an adjustable interest rate for a pool of funds (minimum loan amount $225,000). Rate is only available for a limited time until pool of funds is either depleted or rate expires.

**Advertised estimated monthly payment is based on an interest rate for a 45-day rate lock effective 6/27/25 with a 6.75% / 6.93% annual percentage rate (“APR”). APR of 6.93% is based on an owner-occupied, Conventional 30-year fixed rate mortgage, with a Total Purchase Price of $500,000 and a loan amount of $400,000, 20% down payment and 780 median credit score. Payment includes principal and interest. Estimated property taxes and estimated hazard insurance premiums are not included. Monthly HOA dues paid separately based on the HOA’s then current assessments and are not included in the above calculation. Rates may vary depending on program, down payment and loan amount, market fluctuations, as well as other factors outside of the Seller or Approved Lender’s control. ***$114,000 is calculated using the principal and interest payment difference of $742 per month with a 6.75% interest rate with a 30-year term.

For eligibility of the above finance Promotion, Qualified Buyer of an Eligible Home must (1) pre-apply with Affiliated Lender by visiting www.taylormorrison.com/home-financing prior to submitting offer to qualify for the finance Promotion; (2) use the services of Closing Agent selected only by Seller and finance with Affiliated Lender; and (3) satisfy all other closing date and eligibility criteria. Seller reserves the right to modify the above finance Promotion terms and/or Promotion Period at any time prior to contract. Buyer is not required to finance through Affiliated Lender and/or to use such Closing Agent selected by Seller to purchase a home; however, Buyer must use both the Closing Agent selected by Seller and finance through Affiliated Lender to receive the finance Promotion. Interest rates and available loan products are subject to underwriting, loan qualification, and program guidelines. Maximum seller contributions apply. Not to be combined with any other incentive offer, except as otherwise expressly set forth above or in an Incentive Addendum to the Purchase Agreement. Other restrictions may apply. Not all Borrowers will qualify. Services not available in all states. Taylor Morrison Home Funding, Inc. NMLS #8588, 495 N. Keller Rd. Suite 550, Maitland, FL 32751. Licensed locations: AZ: #0917436 | CA: DFPI #4130023 | CO: Registration #8588, PH# (866) 379-5390 | FL: MLD1920 | GA: #52654 | IN: #DFI-66890 | NV: #3938 (branch located at 1820 Festival Plaza Dr., Ste. 220A, Las Vegas, NV 89135) PH# 702-680-1085| NC: #L-191654 | OR: #ML-4272 | SC: #MLS-8588 | TX: #8588 | WA: #CL-8588 | www.nmlsconsumeraccess.org.

All information (including, but not limited to prices, views, availability, school assignments and ratings, incentives, floor plans, exteriors, site plans, features, standards and options, assessments and fees, planned amenities, programs, conceptual artists’ renderings and community development plans) is not guaranteed and remains subject to change, availability or delay without notice. All Eligible Homes subject to prior sale. This is not an offer in any state where prohibited or otherwise restricted by law. Please see a Taylor Morrison Community Sales Manager or Online Sales Manager for details and visit www.taylormorrison.com for additional state or community specific disclaimers, licensing information or other details (as applicable). © August 2025, Taylor Morrison, Inc. and its respective selling entities (collectively, “Taylor Morrison”). All rights reserved.